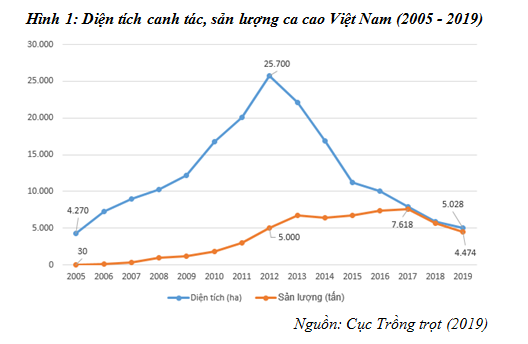

2. Cocoa growing area and output in Vietnam

As a newly developed country in the global cocoa industry, Vietnam produces a very modest annual output of cocoa beans, about 5,500 tons, while the world's output is about 4.8 million tons (Bureau Horticulture, 2019). However, in the international market, cocoa beans from Vietnam have been recognized as having good fermentation quality thanks to early attention to planning and development from the public and private sectors as well as due to poor conditions. typical climate of our country.

According to the Vietnam Cocoa Development Coordination Committee (2019), Vietnam's cocoa cultivation area was highest in 2012 with 25,700 hectares, then continuously decreased, by 2019 it was 5,028 hectares. The provinces with a large decrease in area are Ben Tre, Dak Lak, Binh Phuoc, Lam Dong, Ba Ria - Vung Tau, and Tien Giang. Among them, Ben Tre is the province with the largest decrease in cultivated area, from 9,727 hectares (2012) to 273 hectares (2019).

The causes leading to a significant decrease in cocoa growing area include issues such as: fluctuations in cocoa prices, inappropriate selection of growing areas, limitations in planting techniques, and limitations in cocoa cultivation. from State support policies, and climate change issues.

In Figure 1, it can be seen that although cocoa cultivation area has decreased sharply since 2012, overall output has increased quite steadily over the following years, reaching the highest in 2017 with 7,618 tons of dry beans. This shows that farmers' cocoa productivity is increasing and improving more than before.

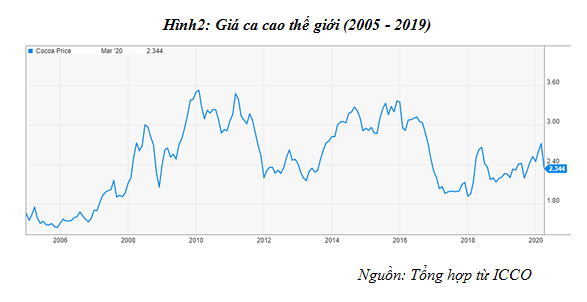

3. Cocoa price situation in the country and in the world

Cocoa prices from 2005 until now have fluctuated with an increasing trend over the years. Domestic prices are heavily influenced by world cocoa prices.

From 2005 to before 2012, world cocoa prices were stable and gradually increased. Domestic dried cocoa beans cost 15,000 - 30,000 VND/kg in 2005 - 2006, and by 2011 the average price was 70,000 VND/kg (about 7,000 VND/kg for fresh fruit). From 2012 - 2013, cocoa prices decreased sharply as shown in Figure 2. This price drop greatly affected the production of the cocoa industry in Vietnam.

In 2012, the price of cocoa beans began to decrease to 62,000 - 65,000 VND/kg and by 2013, it dropped sharply, according to the London floor price, to 54,000 VND/kg (3,000 VND/kg of fresh fruit). During this time, cocoa prices fluctuated and dropped to their lowest, while some crops had much higher economic value and were easier to grow, making farmers impatient to wait. They are willing to cut down cocoa trees to switch to growing fruit trees (green grapefruit, durian, coconut, orange,...). Furthermore, most farmers grow on a small scale and are scattered, making it difficult to provide technical guidance, causing poor plant growth, many pests and diseases, and low productivity. This contributes to making them not "interested" in cocoa, but switching to other trees. The above reasons led to a sharp decrease in cocoa growing area in our country from the end of 2012 to 2013. Since 2014, world cocoa prices began to recover, leading to domestic prices increasing quite high. in 2015, it was 70,000 - 75,000 VND/kg. By 2017, the price decreased slightly to 65,000 - 70,000 VND/kg for dried nuts, the price of fresh fruit was 6,000 VND/kg and this price is maintained until now.

It can be seen that domestic cocoa prices are very sensitive to world fluctuations. This will make farmers afraid in times of sharp declines in prices, because they have limited access to information and lack understanding of the market. To overcome this, there should be a more stable and suitable domestic price compared to the general international price level, so that people can feel more secure in production.

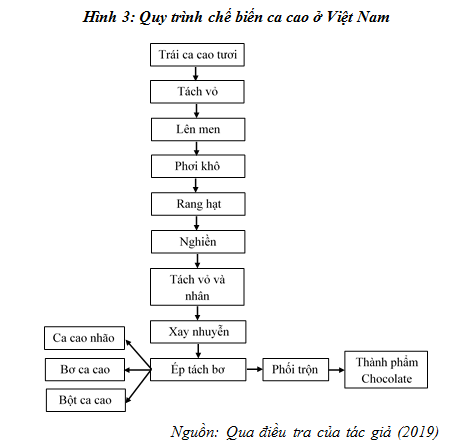

4. Situation of domestic cocoa processing

Currently, Vietnamese cocoa beans are processed through the following forms:

- Preliminary fermentation of beans: cocoa farmers, purchasing households or some local businesses do it. Some businesses with a large scale of preliminary processing and fermentation - such as Puratos Grand Place Company, Trong Duc Cocoa Co., Ltd.,..., have purchased wet fruits or beans for centralized processing and fermentation at the Company. However, centralized cocoa processing and fermentation systems are on the decline due to lack of raw materials.

- Processing semi-finished and finished cocoa products: some small businesses process semi-finished and finished products (such as paste, cocoa powder, cocoa butter, confectionery, chocolate bars, cocoa liquor ,...) mainly supplies food production and domestic demand.

Vietnam currently ranks 23rd on the list of countries with good-tasting cocoa products, becoming the second Asian country to achieve this title after Indonesia, but up to 40% of cocoa production is recognized in when Indonesia only has a rate of 1% (Sonia Gregor, 2017). This difference, in addition to the soil factor, also comes from the natural fermentation method to create uniqueness. It is the process of fermenting cocoa, roasting and grinding beans to bring out the characteristic fruit flavor inherent in Vietnamese cocoa beans. The current cocoa processing process in Vietnam is shown in Figure 3 .

5. Situation of cocoa production, purchasing, import and export

- Regarding production and export:

Currently, domestic production does not meet the purchasing needs of domestic and foreign units for processing and export. Cocoa beans are exported through: Armajaro Company, Atlantic Vietnam Commercial Products Company Limited (Acon), Ben Thanh Technology Solutions Company Limited. Some companies process cocoa paste, powder, butter (Pham Minh Company) or process semi-finished products such as wine, chocolate and cocoa powder, confectionery, milk, etc. (Trhong Duc Cocoa Company Limited , Vina Cocoa, Binon Cocoa,…). Chocolate products made from Vietnamese cocoa beans are highly appreciated internationally and have won awards around the world (such as products of Marou Company, Stone Hill Company).

- Regarding certified production:

According to data from UTZ Certified, certified cocoa production in Vietnam has increased rapidly since 2011, reaching the highest level in 2014 with 16 participating production units, with 3,323 households, 2,822 hectares and an output of 2,654 tons of beans. UTZ certification. During this period, most of the costs were supported by UTZ Certified organizations, Helvetas Vietnam, etc. However, after 2014, when support from organizations decreased, certified production also decreased. By December 2017, there were 2 certified production units with 286 households, 285 hectares and an output of 330.3 tons in the provinces of Dak Lak, Dak Nong, Ba Ria - Vung Tau, Dong Nai, and Ben Tre. The reason is said to be due to: the strong development of pests and diseases on cocoa trees, leading to large production costs, causing losses to producers; The competitiveness of cocoa trees is not superior compared to some other strong crops due to low productivity, not outstanding economic efficiency, and unstable market; and the low national cocoa output makes foreign traders hesitant to invest (Department of Crop Production, 2019).

6. Investment activities and cooperation in cocoa production

With increasing demand while supply is still low, there are currently a number of businesses and organizations researching and investing in developing the cocoa raw material market in Vietnam. For example, the investment project to build a large cocoa sample field of Trong Duc Cocoa Company Limited, Bamboo Capital Joint Stock Company in Dong Nai province, Cao Nguyen Xanh Company Limited in Dak Lak province. In addition, some companies have invested in factories to process cocoa products with advanced technology - such as Trong Duc Cocoa Company; Kimmy Company; Binon Cocoa - at the same time investing in building an eco-tourism area to experience cocoa.

However, these investment activities still encounter many difficulties, many projects have not been implemented. The reason is that the cocoa area is small, fragmented and has decreased sharply, farmers are not interested, and have not received adequate support from local authorities, so businesses are still afraid to be bold or do not have enough conditions. to make investments.

Production links between companies and farmers still face many difficulties, also stemming from the above reasons. In addition, there is another reason that comes from the characteristics of cocoa trees in Vietnam, which is that cocoa trees like shade and their economic value is not high, so it only makes sense to intercrop with other trees to improve income. imported to farmers but not able to compete with high-value crops, such as green-skinned grapefruit, durian, custard-apple, etc. Therefore, when the cocoa production situation is difficult, it cannot meet the needs of farmers. As expected by people, competition between cocoa trees and other fruit trees is becoming more and more fierce. Therefore, they will easily change crops. This increases the risk of breaking the connection between farmers and companies, causing companies to face many difficulties in production, and new investors are not willing because of many concerns.

7. Advantages and disadvantages of Vietnam's cocoa industry

Through the overall analysis of the Vietnamese cocoa industry above, the main difficulties and advantages of the current Vietnamese cocoa industry can be recorded as follows:

a. Favorable

- The world's demand for cocoa is increasing, so the output for Vietnamese cocoa beans is very favorable. Furthermore, a wide purchasing network has been established in the country in cocoa growing areas. The cocoa market is showing signs of excitement again.

- Cocoa productivity is gradually improved, most of the farmers' cocoa beans are centrally fermented by buying companies and businesses, so the quality of the beans is increasingly uniform, better than the case of letting people do it themselves. fermented in the garden. In addition, certified production and processing is increasingly receiving attention. Vietnamese cocoa is evaluated by the World Cocoa Organization as cocoa with good flavor, bringing status and advantages to the Vietnamese cocoa industry.

- Domestic cocoa processing is receiving attention, investment, and production from many domestic and foreign enterprises, creating cocoa products for domestic consumption and initially asserting themselves in the international market (such as products of companies Marou, StonHill, Savie, Belvie,...).

- New varieties, updated technical advances, basically determining the variety structure for three main production areas; At the same time, the Technical Cultivation Process, Bean Pre-processing and Fermentation Process, Pest Prevention Process, and Vietnamese Standards for Vietnamese Cocoa Seedlings have been issued. This contributes to ensuring the quality of Vietnamese cocoa becomes increasingly better.

- A number of domestic and international organizations and businesses are building concentrated cocoa production areas with large annual production scale in the provinces of Dak Lak and Dong Nai.

b. Hard

- The economic efficiency of cocoa trees is not really attractive to farmers so they can feel secure in investing in care and cocoa trees are facing strong competition with high-value fruit trees.

- Previously, building intensive cocoa growing areas was carried out in some areas but did not achieve the expected results. Currently, most cocoa areas are mainly intercropped under coconut, cashew, and fruit trees with small and scattered production scales, making it difficult to improve output and productivity. Furthermore, limitations in planting techniques and anti-pest measures in the rainy season are also the causes leading to reduced productivity and cocoa production efficiency.

- Support policies from the State for cocoa trees are still limited. Some localities have development policies but resources are lacking, leading to some cocoa programs and projects being approved but not having enough funding to implement.

- Domestic purchasing prices still depend heavily on fluctuations in international market prices, the link between production and consumption is not tight, businesses still face many difficulties in strengthening links with agriculture. people.

- Although there are currently some businesses investing in producing finished cocoa products instead of just processing cocoa beans and powder as before, the output of finished products is still very small. The amount of finished products exported is insignificant. Therefore, the added value in processing is still very limited.

Through an overall analysis of Vietnam's cocoa industry, it is found that, to restore the prosperous development of Vietnam's cocoa industry, there will be a lot of work that needs to be done and requires cooperation and coordination. combination of farmers, businesses, state agencies and scientific researchers. This situation raises issues and solutions that need attention and implementation in the future.

CITATED DOCUMENTS:

[1] DANIDA: Danish International Development Agency.

[2] GTZ: Agency for international development of the Federal Republic of Germany.

[3] SUCCESS Alliance: Project "Developing sustainable cocoa production for farmer households in Vietnam" (referred to as SUCCESS Alliance) is coordinated by the Ministry of Agriculture and Rural Development and ACDI/VOC - conducted by an American non-governmental organization.

[4] PSOM: Dutch Partnership Program for Connected Markets funded by the Dutch Government.

[5] Helvetes: Swiss Association for International Cooperation.

[6] UTZ Certified: Global certification program.

REFERENCES:

1. Ministry of Agriculture and Rural Development (2012). Decision No. 2015/QD-BNN-TT dated August 23, 2012 of the Ministry of Agriculture and Rural Development on approving cocoa development planning in the southern provinces until 2015 and orientation to 2020.

2. Department of Crop Production (2019). Situation of Vietnam's cocoa production in 2019 and development orientation in the coming time. Conference summarizing 2019 activities and directions for 2020 organized by the Vietnam Cocoa Development Coordinating Board on November 11, 2019, City. Vung Tau.

3. Sonia Gregor (2017). Marou cocoa report 2017.

Source: Internet

Mọi chi tiết xin vui lòng liên hệ:

CÔNG TY TNHH CA CAO TRỌNG ĐỨC

Số 12, Khu Dân Cư 16, Ấp 4, Xã Phú Hoà, Huyện Định Quán, Tỉnh Đồng Nai.

ĐT: (02513) 629 168 - 0965 724 545 Fax: (02513) 620 000

Chi nhánh TP.HCM

* Chi nhánh: 11 An Nhơn, Phường 17, Gò Vấp, Tp.HCM

Điện thoại: 0286.257.1707

Email: huynhthiphuong.td@gmail.com - tothaiha.td@gmail.com

Website: www.trongduccaocao.vn - www.cacaotrongduc.com